Upcoming Events

Fall 2025 MAP (Money Awareness Program) Events can be found here.

Financial Literacy Office @ The Barnes Center: Money and Mental Health

Join the Office of Financial Literacy for an engaging session exploring the connection between money and mental health. Learn strategies to manage financial stress, build healthier money habits, and strengthen your overall well-being.

Friday, October 10 | 12:00 PM | Location: TBD

Introduction to Investing – College Edition

Curious about investing but not sure where to start? The Office of Financial Literacy invites you to this beginner-friendly workshop designed specifically for college students. Discover the basics of investing, how to make informed decisions, and ways to begin building your financial future today.

Friday, November 7 | 12:00 PM | Location: TBD

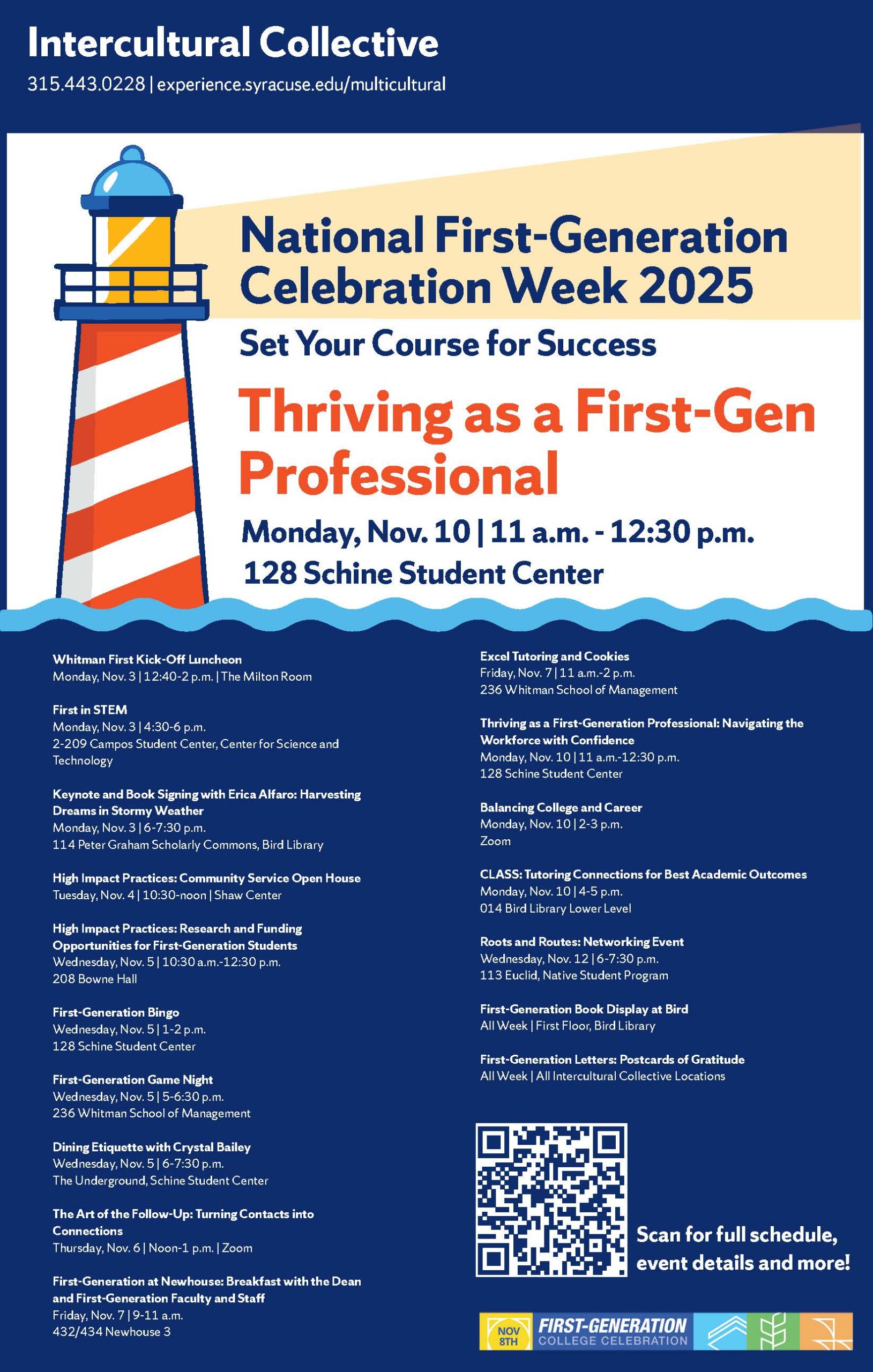

National First-Generation Celebration Week 2025

More information can be found here.